The proposed tax hikes on mansions would generate $26.8 million in extra annual revenue.

There’s a new target in San Francisco’s income inequality wars: luxury mansions. Jane Kim, a member of the city’s board of supervisors, is seeking to put a proposal before the voters in November that would increase transfer taxes on homes sold for more than $5 million, with properties worth more than $25 million incurring a minimum fee of $750,000 typically paid by the sellers. “There is a strong sense right now in San Francisco that affordability is the No. 1 issue, and the economic divide that we’re seeing here is unprecedented and stark,” says Kim, a civil rights lawyer who’s running for the state legislature. “While we cannot stop people from coming to San Francisco and encouraging this luxury economy, we can ask them to help pay for the crisis that they are contributing to.”

The influx of highly paid technology workers into the city has fueled some of the highest rents and home prices in the U.S., spurring public outcries over tenant evictions and the increase in homelessness. Protesters have frequently targeted the commuter buses that ferry tech workers to jobs in Silicon Valley, about 40 miles south of the city. “San Franciscans are upset that the city has prioritized the wealthy developers and speculators over everyday San Franciscans,” says Sarah Sherburn-Zimmer, executive director of the Housing Rights Committee of San Francisco, which has organized anti-eviction protests.

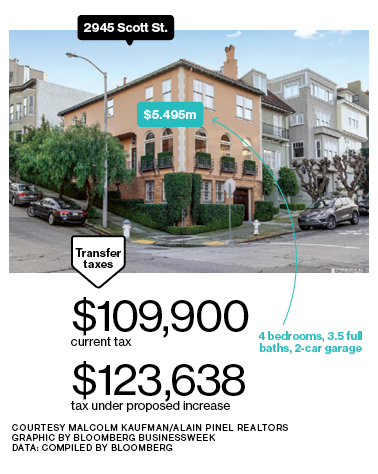

The issue has dogged Mayor Ed Lee, who’s credited with drawing the technology companies to the city. He was elected to a second full term in November on a “shared prosperity” agenda. Kim’s proposal, which requires support from five other members of the board of supervisors to appear on the November ballot, would increase the tax on properties worth $5 million to $10 million by a quarter point, to 2.25 percent. The transfer tax on properties sold for $10 million to $25 million would also rise a quarter point, to 2.75 percent, and homes worth more than $25 million would be taxed 3 percent—a new bracket that increases the tax on such homes by half a percentage point.

The tax hikes would generate $26.8 million in extra annual revenue, says Drew Murrell, citywide revenue manager in the division of budget and analysis at the San Francisco Controller’s Office. The city collected $240 million in transfer taxes on properties worth more than $5 million in fiscal 2015, a 33 percent increase from fiscal 2012, city data show.

The San Francisco metropolitan area had the highest median home price in the U.S. in November, at $1.1 million, according to the most recent data from consumer analytics firm CoreLogic. There are currently two home listings for $25 million or more in the area, out of 294 across the U.S., Zillow data show. There are 99 listings in the San Francisco metro area for homes worth $5 million to $25 million.

Taxing the wealthy has become a popular policy in California, where voters in 2012 approved temporary income tax increases on people making more than $250,000. At the time, California faced a $9 billion budget shortfall; the taxes generated $15.2 billion over the last two fiscal years, helping to erase the state’s budget deficit. The state’s largest teachers union and the California Hospital Association are among groups pushing to extend the income tax increases.

Some brokers aren’t thrilled at the prospect of additional taxes on multimillion-dollar properties. “Homes selling for higher prices in San Francisco already pay substantially higher transfer taxes than the norm,” says Patrick Carlisle, chief market analyst at the city’s Paragon Real Estate. “Increasing them significantly constitutes an unfair penalty being levied upon certain homeowners simply because of their financial success.”

Others say the proposed real estate tax would depress prices of homes that should be worth more than $5 million to just below that amount, so sellers can avoid the additional fees. “At that price point, the city already gets a healthy chunk,” says John Kirkpatrick, a broker at Pacific Union International, a real estate firm in San Francisco. He’s currently listing his own three-bedroom condo at the St. Regis in the city’s South of Market district for $5.5 million. “The perception is that San Francisco is becoming more heavily taxed than other cities. It’s not good for business.”

No comments:

Post a Comment