- Energy-state slumps put economists on alert for wider decline

- In West Virginia, everyone needs to `tighten their belts'

Dale Oxley doesn’t need to hear about rising odds of a U.S. recession to dread the future. For the West Virginia homebuilder, the downturn has already arrived.

“Everyone is going to have to tighten their belts,” said Oxley, the 48-year-old owner of a Charleston-area construction company. “The next couple of years are going to be difficult.”

As economists size up the chances of the first nationwide slump since 2009, pockets of the country are already contracting. Four states -- Alaska, North Dakota, West Virginia and Wyoming -- are in a recession, and three others are at risk of prolonged declines, according to indexes of state economic performance tracked by Moody’s Analytics.

The regions suffering the most are in the flop stage of the energy industry’s boom-to-bust cycle, and manufacturing-dependent areas hurt by a rising dollar are at risk of receding. Whether the weak links break the entire U.S. economy will hinge largely on a group that’s benefited from the energy price collapse: American consumers.

“The impetus for weakening regional economies is the huge fall in energy prices and other commodities prices, which is taking a tremendous toll,” said Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities Inc. in New York, who is concerned of a broadening into a national recession. “If the consumer were to falter for any reason, that would be a big problem.”

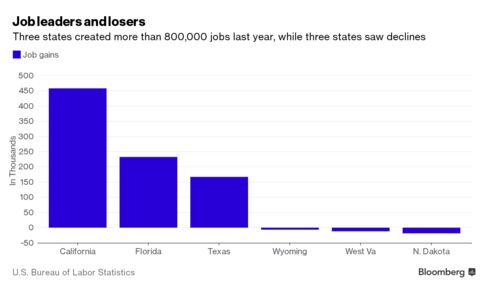

Job gains and losses are key factors that the National Bureau of Economic Research uses to chart U.S. expansions and recessions. Even as U.S. employers added 2.7 million workers in 2015, job cuts last year totaled 18,800 in North Dakota, 11,800 in West Virginia and 6,400 in Wyoming, according to the U.S. Labor Department.

The common thread? They all have concentrations of energy companies. A 72 percent plunge in crude oil prices since a peak in June 2014 has led to lower production and firings.

So far, Federal Reserve officials view the patches of hardship as isolated and the chance of a recession as remote. Chair Janet Yellen told Congress on Feb. 10 that falling energy prices “have caused companies to slash jobs and sharply cut capital outlays,” but she didn’t expect a nationwide recession.

“There would seem to be increased fears of recession risk” reflected in tightening financial conditions, she said in her testimony. “We’ve not yet seen a sharp drop-off in growth, either globally or the United States, but we certainly recognize that global market developments bear close watching.”

Still, seven of the 50 U.S. states have had downturns in economic activity over the final three months of last year, according to tracking by the Philadelphia Fed.

Louisiana, New Mexico and Oklahoma are all at risk of recession, according to Moody’s. Wyoming and North Dakota’s economies have declined for at least the past 10 months, according to the Philadelphia Fed.

The median probability for a U.S. recession in the next 12 months jumped to 20 percent in a Bloomberg survey of economists this month, the highest since February 2013.

Dollar’s Strength

A second blow to regional economies is the dollar’s surge, reflected in a 22 percent increase in the Bloomberg Dollar Spot Index since mid-2014, which is weighing on U.S. producers that compete globally. Illinois, Wisconsin, Louisiana and Mississippi --manufacturing states hurt by the currency’s march higher -- have all had economic declines in the past few months.

The spottiness of the expansion represents a turnaround from the broad recovery after the deepest downturn since the 1930s. As recently as October 2014, every state was expanding, according to Paul Flora, an economist with the Philadelphia Fed.

For every 25 percent drop in oil prices, employment could be expected to decline 0.6 percent in Texas and 0.8 percent in Louisiana, while Wyoming stands to lose 2.1 percent of its jobs and North Dakota and Oklahoma about 1 percent each, according to research by Stephen Brown, an economist at the University of Nevada, Las Vegas, and Mine Yücel, director of research at the Dallas Fed.

Growth in Texas has slowed with falling oil prices, though the state continues to expand because of a diversified economy including technology jobs in Austin and development in Dallas. Texas added 166,900 jobs in the year ended in December, behind only California and Florida.

The situation today echoes what happened three decades ago, when falling commodities prices caused regional pockets of distress in energy and farm states, Flora said. “This seems similar to 1985-86 which did produce a recession in Texas and other energy states,” he said. “But it did not spread to the rest of the nation.”

This time around, the relatively healthy state of American consumers may keep the economy afloat. Retail sales rose 3.4 percent in January from a year earlier, the biggest jump in a year, and stagnant wages are showing signs of perking up: Average hourly earnings in December rose 2.7 percent from a year earlier, the biggest advance since mid-2009.

“We’re taking account of the fact that the energy sector is very hard hit. We’re losing jobs there,” Yellen said Feb. 10. “But with respect to employment, although there really are very severe losses, it’s a pretty small sector of the work force overall.”

That’s cold comfort in places like Kimball, West Virginia, where the setbacks include the closing of a Wal-Mart store. “We are experiencing stagnation overall in the rest of the economy,” said John Deskins, an economist at West Virginia University in Morgantown.

Oxley, the builder, said his company’s business has held up more than most in part because he serves wealthier customers, including doctors, who continue doing well. Still, recession conditions are dampening everyone’s confidence.

Oxley’s Modern Home Concepts built four $500,000 custom homes last year in southern West Virginia, down from five in 2014 and fewer than half 2009’s level, when the last U.S. recession ended. About 200 people are employed on contract for each home, he said.

“There is not a lot of job creation and you are not creating new households,” he said. “I am not optimistic in regard to our future in West Virginia.”

No comments:

Post a Comment