Talk of a downturn is in the air, and the numbers are squiggly

People who ordinarily ignore economic forecasters are eager for whatever intelligence they can glean. What’s grabbed their attention is the January plunge in the U.S. stock market, the worst two-week start on record. If the bears are right, profits and economic growth in general are going to be weak in 2016. Even if the bears are wrong, the drop is making investors less willing to spend. Nobody knows what’s going to happen next. “The fact that economists have a particularly poor track record of calling turning points in growth only adds to underlying anxiety,” Joseph LaVorgna, chief U.S. economist at Deutsche Bank Securities, wrote to clients on Jan. 19.

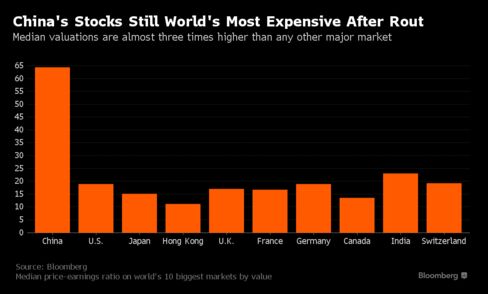

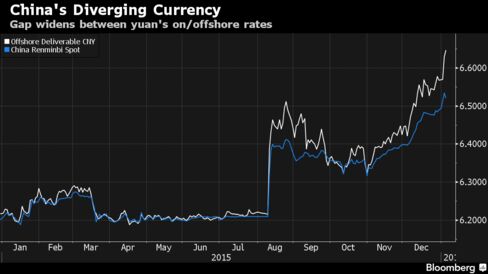

Weakness is emanating from China, where pessimism has driven stock prices down 40 percent since June, vs. a decline of 12 percent in the U.S. With trade declining, there’s been a sharp drop in the Baltic Dry Index, a measure of cargo shipping rates. Oil prices are also down, reflecting not just an increase in supply but falling demand. That’s bad for businesses and workers in the U.S. oil patch. One way trouble abroad gets transmitted to the U.S. is through a rising dollar. When other economies weaken, the world’s investors flood into the U.S. in search of higher returns, buying dollars as they do. The strong dollar is already showing up in a decline in import prices —bad news for U.S. companies that compete with imports. The Morgan Stanley Business Conditions Index fell this month to its lowest level since February 2009. Ellen Zentner, Morgan Stanley’s chief U.S. economist, headlined her report, “Losing Faith.” Auto sales , which had been climbing steadily for years, have fallen from their peak. Manufacturers, more sensitive to trouble abroad because of their reliance on exports, have seen a sharp drop in their main index of activity. The economies of more than 9 in 10 U.S. counties still haven’t gotten back to their prerecession peaks. Analysts estimate that profits of Standard & Poor’s 500 companies in the last quarter of 2015 had their biggest drop from the year before since 2009, according to data collected by Bloomberg.

While all this is going on, the Federal Reserve has its finger on the interest rate trigger. The Federal Open Market Committee has already raised the federal funds rate target once, to a range of a quarter percent to a half percent. The midpoint of the “dot plot” of Fed officials’ forecasts is for the federal funds rate to reach 1.25 percent to 1.5 percent by the end of 2016, a level that bears think could stop the fragile U.S. expansion.

There’s nothing fragile about this expansion, answer the bulls. The economy has created millions of jobs since the last recession, including 292,000 jobs in December. This is the longest run of consecutive monthly employment gains in records going back to 1939. The U.S. Bureau of Labor Statistics tracks an index of payrolls consisting of average hourly pay multiplied by average hours worked per week multiplied by the number of workers. It’s up one-third from six years ago. In a virtuous cycle, payroll growth enables stronger consumer spending, which feeds back into more job growth. The number of openings has more than doubled since 2010 to better than 5 million, indicating that the hiring expansion has room to run. Sure, the pace of initial filings for unemployment insurance has picked up a bit, but it’s still far below its recent average.

The cheap oil that the bears worry about is good news for the bulls, because lower gas prices leave more money for people to spend on other things. Americans have been paying down debt, and their financial obligations have been declining as a share of their disposable income Consumer sentiment is close to its strongest of this business cycle. And there’s no hint of a bursting housing bubble: True, construction starts fell in December despite warm weather. But affordability remains well above the worst levels of 2006 and 2007. The bottom line is that a 2016 recession is unlikely. The Conference Board’s index of leading economic indicators points to growth. Macroeconomic Advisers , a forecasting firm, expects the economy to bounce back from a very weak fourth quarter in 2015. Participants in the Federal Reserve Bank of Philadelphia’s latest Survey of Professional Forecasters see only a small chance of gross domestic product shrinking in any quarter this year. Then again, those soothsayers weren’t predicting a recession at the start of 2008, either. They didn’t realize that one had already begun.