For the state of Russia’s finances, consider places like Chukotka, the territory separated from Alaska by a narrow strait.

The government there has racked up debt equal to 144 percent of its revenue, the highest in Russia, according to Standard & Poor’s. Regions from Belgorod near Ukraine to three North Caucasus republics are also prompting concern with ratios topping 100 percent. The premium investors demand to hold Russian municipal bonds over sovereign securities is the highest in more than a month and 103 basis points more than last year’s average, according to UralSib Capital data.

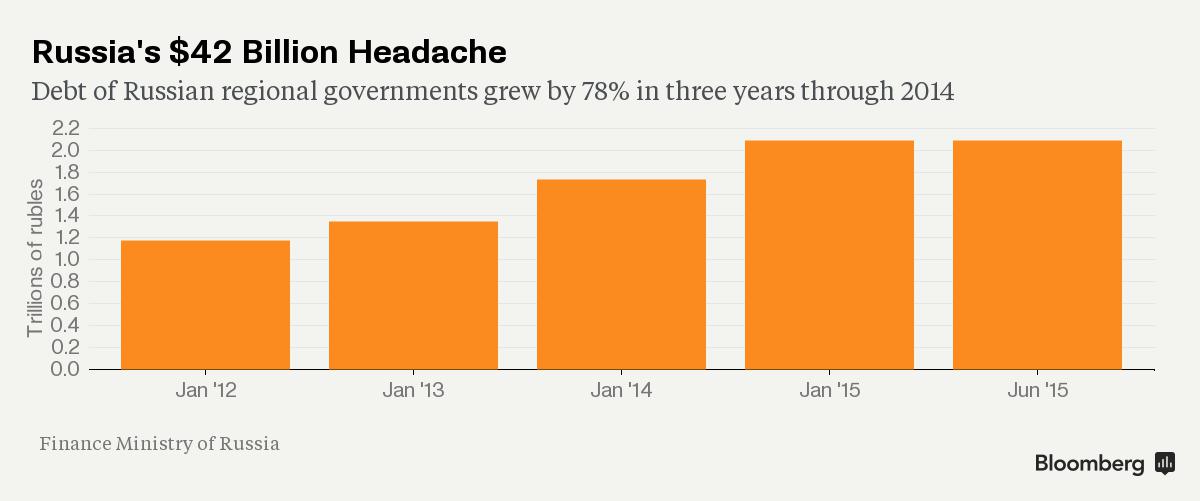

The clock is ticking for President Vladimir Putin to defuse a situation he set off in 2012 with decrees to raise social spending. That contributed to a doubling in the debt load of Russia’s more than 80 regions to 2.4 trillion rubles ($42 billion) in the past five years. Strains on their finances will grow critical in two or three years, raising the risk of bailouts from a federal budget already running a deficit for the first time since 2010, according to S&P.

“A default by a large region could block market access for the Finance Ministry itself,” said Karen Vartapetov, associate director of S&P’s Moscow office. “Right now the federal center has an opportunity to help regions. In three years, there may be fewer resources, while regional debt may be bigger, and that will result in greater risks.”

The Finance Ministry in Moscow didn’t reply to a request for comment on the risks facing regional governments.

Yawning Gap

Threats to municipal finances are snowballing as sanctions over Ukraine choke access to capital markets, forcing local governments to fund social outlays with costlier bank loans.

While regional debt sales are down 53 percent so far this year, Moody’s Investors Service estimates borrowing will grow as much as 25 percent in 2015, driven by spending on health care, education and utilities.

The government there has racked up debt equal to 144 percent of its revenue

The squeeze is putting regions in jeopardy. They’re facing “an increasing likelihood of defaults,” S&P warned in June. At least one non-rated local government delayed a principal repayment on a bank loan in the first quarter, it said.

Local administrations are running a 625 billion-ruble deficit, up 42 percent from 2014, according to S&P. Seventy-five regions had a budget gap last year, the Higher School of Economics in Moscow said in a May report.

Refinancing Issues

Belgorod, a region of 1.5 million people, is one of only five municipal borrowers this year, placing 5.3 billion rubles of sinkable five-year notes this month at a coupon of 12.65 percent. That compares with a 8.3 percent coupon on seven-year bonds sold in 2013. The yield on Belgorod’s notes due June 2020 has fallen three basis points to 13.15 percent since trading began July 8.

The authorities in Moscow want to ease the crisis by helping regions replace bonds and commercial loans with subsidized loans from the federal budget, offered at a 0.1 percent annual rate. Russia will allocate 310 billion rubles to this in 2015, according to Prime Minister Dmitry Medvedev, who’s backed converting some foreign-currency debt into rubles.

Even so, local governments continue to rely on commercial loans, increasing bank debt by a quarter since the start of 2014 to 1 trillion rubles on March 1, central bank data show.

Risks of imbalances in regional budgets will probably grow this year as the economy shrinks, the central bank said in June.

“Because of the high debt burden, access to market sources of financing may be partly closed for some regions,” it said. “In addition, these regions may have difficulties with refinancing existing debt because banks are becoming more selective in assessing regional risk.”

No comments:

Post a Comment