Despite record home prices in some big cities, the U.S. market is nowhere near as bad as it was a decade ago.

Home prices have hit record highs in some major U.S. metropolitan areas, and house-flippers are behaving like it’s 2005: It’s no wonder people are chattering about another housing bubble.

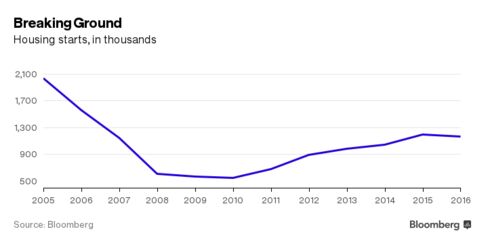

But residential real estate isn’t in a speculative bubble, industry observers contend. Instead, a low inventory of available homes is driving prices higher—prices, however, will eventually recede as buyers throw up their hands, or as more new homes come on line. The structural issues that led to the housing collapse last decade aren't present.

“The havoc during the last cycle was the result of building too many homes and of speculation fueled by loose credit,” said Jonathan Smoke, chief economist at Realtor.com. “That’s the exact opposite of what we have today.”

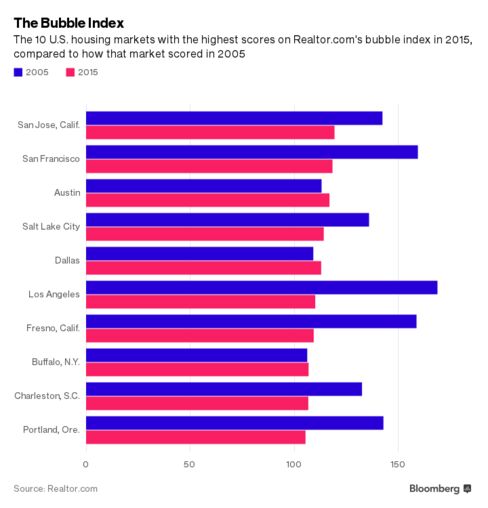

To illustrate his point, Smoke compiled an index based on six factors he deemed crucial to the housing boom and bust of the mid-2000s, including price appreciation, the prevalence of house-flipping, and share of buyers who used mortgage financing. (The other factors are price-to-income, price-to-rent, and housing starts-to-household formation.) Then he benchmarked the index to 2001, a year when the housing market was fairly valued.

Last year, only six metro areas exceeded the benchmark by 10 percent, with San Jose coming in highest, at 19 percent above 2001 levels. In 2005, there were 29 cities that were at least that bubbly, as the chart below shows:

The local markets that look the most like a bubble are, unsurprisingly, places where population is growing faster than housing supply. That includes California cities where zoning regulations have slowed or prevented new construction, as well as Texas markets in which rising land and labor costs, and some lingering aftershocks from the bust, have held back housing starts. Meanwhile, the share of U.S. households that rent is near 50-year highs, helping to drive up rental prices and giving investors across the country incentive to snatch up for-sale homes.

Prices in Austin and the San Francisco Bay Area, among other places, are probably unsustainable, Smoke said. That could be bad for buyers who get in at the top of the market and bad for the local economy if high housing costs spur talented workers to move away. “We could have a housing cost-induced economic slowdown because people can’t make the housing market work,” Smoke said.

Figuring out how to create enough new housing to meet demand is a tricky question. In one scenario sketched out by Smoke, faster economic growth would lead to higher interest rates, leading banks to lend more easily to homebuyers. In another, a bad economy could slow household growth, dampening demand. Right now, builders are starting new homes at a modest clip despite significant demand, probably because the cost of building them outweigh the prices homes are fetching. “If you were a builder and you could do it, wouldn’t you?” Smoke asked.

The current housing market isn’t without some pockets of speculation, said Daren Blomquist, senior vice president at RealtyTrac. A rule of thumb for investors who flip homes is to buy at a 30 percent discount to the local market, he said. That leaves room to fix up the house and sell at a profit. In the first quarter of 2016, flippers in Denver were buying at a 14 percent discount to market prices, and flippers in Orange County, Calif., were buying at an 11 percent discount.

“They’re riding the wave of rising home prices,” Blomquist said. “They’re not buying low—they’re hoping that they can sell high.”

Selling USA FRESH SPAMMED SSN Leads/Fullz, along with Driving License/ID Number with EXCELLENT connectivity.

ReplyDelete**PRICE**

>>1$ FOR EACH FULLZ WITHOUT DL NUMBER

>>2$ FOR EACH LEAD/FULLZ/PROFILE

>>5$ FOR EACH PREMIUM LEAD/FULLZ/PROFILE

**DETAILS IN EACH LEAD/FULLZ**

->FULL NAME

->SSN

->DATE OF BIRTH

->DRIVING LICENSE NUMBER WITH EXPIRY DATE

->ADDRESS WITH ZIP

->PHONE NUMBER, EMAIL, I.P ADDRESS

->EMPLOYEE DETAILS

->REALTIONSHIP DETAILS

->MORTGAGE INFO

->BANK ACCOUNT DETAILS

>All Leads are Tested & Verified.

>Invalid info found, will be replaced.

>Serious buyers will be welcome & I will give discounts on bulk orders.

>Fresh spammed data of USA Credit Bureau

>Good credit Scores, 700 minimum scores

>Bulk order will be preferable

>Minimum order 20 leads/fullz

>Hope for the long term business

>You can asked for samples, specific states & zips (if needed)

>Payment mode BTC, ETH, LTC, Paypal & PERFECT MONEY

Email > leads.sellers1212@gmail.com

Telegram > @leadsupplier

ICQ > 752822040

''OTHER GADGETS PROVIDING''

>SSN Fullz

>CC fullz

>Dead Fullz

>Carding Tutorials

>Hacking Tutorials

>SMTP Linux Root

>DUMPS with pins track 1 and 2

>Sock Tools

>Server I.P's

>USA emails with passwords (bulk order preferable)

**Contact 24/7**

Email > leads.sellers1212@gmail.com

Telegram > @leadsupplier

ICQ > 752822040