- HSBC Official Said to Face Charges in FX Rigging Probe

- Mark Johnson arrested at Kennedy Airport Tuesday in New York

- Cairn Energy said to be the unidentified front-running victim

Federal agents surprised an HSBC Holdings Plc executive as he prepared to fly out of New York’s Kennedy airport around 7:30 p.m. Tuesday, arresting him for an alleged front-running scheme involving a $3.5 billion currency transaction in 2011.

Mark Johnson, HSBC’s global head of foreign exchange cash trading in London, was held in a Brooklyn jail overnight and will appear in court Wednesday, according to prosecutors. The U.S. unsealed a complaint against him and Stuart Scott, the bank’s former head of currency trading in Europe, making them the first individuals to be charged in the long-running probe.

The arrest and charges are a coup for the Justice Department, which has struggled to build cases against individuals in its investigation into foreign-exchange trading at global banks. U.S. prosecutors once had so much confidence in the quality of evidence they were gathering thanks to undercover cooperators that in September 2014, then-Attorney General Eric Holder said he expected charges against individuals within months. The U.K. Serious Fraud Office also found it difficult to make cases against currency traders and announced in March that it was dropping its efforts.

“This case demonstrates the criminal division’s commitment to hold corporate executives, including at the world’s largest and most sophisticated institutions, responsible for their crimes,” Assistant Attorney General Leslie Caldwell said in an e-mailed statement.

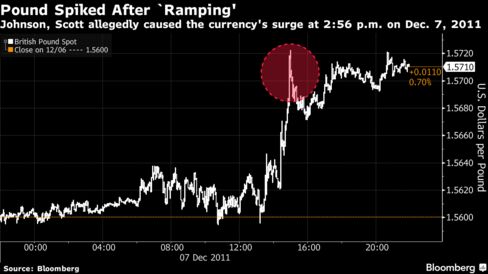

The two allegedly conspired to take advantage of inside information about an unidentified company’s plans to sell part of its stake in an Indian subsidiary, according to the complaint. The client was Cairn Energy Plc, which was selling the unit to Vedanta Resources Plc, according to people with knowledge of the transaction. HSBC was hired to trade about $3.5 billion in proceeds of the sale to pounds. Johnson and Scott began buying pounds in the days before the transaction, anticipating that they would cause the price of pounds to spike -- a practice known as “ramping” -- then execute the transaction, making the pounds they’d bought earlier more valuable, according to the complaint.

‘Element of Surprise’

Scott and Johnson -- his supervisor at the time -- told the client the deal should take place at 3 p.m. “so there’s an element of surprise” to get a better rate, according to the complaint, which quoted from recorded phone calls and messages between the two and their client. There was less liquidity at the 3 p.m. fix than the one at 4p.m., making it easier to manipulate, though they told their client they were about the same.

They and other traders they directed ramped the price, sending the pound to its highest in two days at 2:56 p.m. London time. When Scott told Johnson the client was still going ahead with the full transaction despite the spiking price, Johnson said “Ohhhh, f***ing Christmas,” according to the complaint. In the end, HSBC and the men’s internal accounts reaped about $8 million from the front-running, according to Brooklyn U.S. Attorney Robert Capers.

“The defendants allegedly betrayed their client’s confidence, and corruptly manipulated the foreign exchange market to benefit themselves and their bank,” Caldwell said. Johnson and Scott blamed the pound’s rise on an unidentified Russian bank in their conversations with the client afterwards, according to the complaint.

Rob Sherman, an HSBC spokesman, and Peter Carr, a Justice Department spokesman, declined to comment. Johnson and his lawyer, Frank Wohl, didn’t immediately respond to calls seeking comment. Contact information for Scott wasn’t immediately available in U.K. directories.

Extradition Concerns

Both men are British citizens. The U.S. complaint was kept under seal for fear Johnson, 50 and a resident of both the U.S. and U.K., would flee if he heard about it, according to the document. Agents moved quickly to arrest Johnson, who works in London and New York, to avoid difficulties that could arise in extraditing him, according to a person with knowledge of the matter. HSBC wasn’t made aware of the plans to arrest Johnson, another person said, asking not to be identified because the details aren’t public.

Scott left the bank in 2014 after it agreed to pay $618 million to settle currency-rigging investigations by the U.K. Financial Conduct Authority and the U.S. Commodity Futures Trading Commission. The 43-year-old remains in the U.K., and the U.S. is likely to seek extradition, according to one of the people.

Johnson’s arrest comes more than a year after five global banks pleaded guilty to charges related to the rigging of currency benchmarks. HSBC, though it settled regulatory cases, is still being investigated by the Justice Department. The bank has set aside $1.3 billion for possible settlements, according to an August filing.

Antitrust, Fraud

The Justice Department’s investigation into the manipulation of currency markets by the world’s biggest banks has looked at two issues: whether bankers from competing institutions colluded to sway benchmarks in their favor in violation of antitrust laws and whether bankers were committing fraud with client orders. The charges against Johnson and Scott were brought by federal prosecutors in Brooklyn working with the Justice Department’s fraud section in Washington.

Separately on Tuesday, the U.S. Federal Reserve banned former UBS Group AG trader Matthew Gardiner from the banking industry for life for his role rigging currency benchmarks. Gardiner used electronic chat rooms, with names including The Cartel and The Mafia, to facilitate the rigging of foreign-exchange benchmarks and to disclose confidential customer information to traders at other banks, the Fed said in a statement Tuesday. That matter is separate from the one involving Johnson, the people said.

Gardiner has been helping U.S. prosecutors who are trying to build currency-rigging cases against individuals for violation of antitrust laws, two people familiar with the matter told Bloomberg News in April. He hasn’t been publicly charged and it isn’t clear if he has been granted immunity for cooperation. A lawyer for Gardiner didn’t respond to an e-mail seeking comment.

Selling USA FRESH SPAMMED SSN Leads/Fullz, along with Driving License/ID Number with EXCELLENT connectivity.

ReplyDelete**PRICE**

>>1$ FOR EACH FULLZ WITHOUT DL NUMBER

>>2$ FOR EACH LEAD/FULLZ/PROFILE

>>5$ FOR EACH PREMIUM LEAD/FULLZ/PROFILE

**DETAILS IN EACH LEAD/FULLZ**

->FULL NAME

->SSN

->DATE OF BIRTH

->DRIVING LICENSE NUMBER WITH EXPIRY DATE

->ADDRESS WITH ZIP

->PHONE NUMBER, EMAIL, I.P ADDRESS

->EMPLOYEE DETAILS

->REALTIONSHIP DETAILS

->MORTGAGE INFO

->BANK ACCOUNT DETAILS

>All Leads are Tested & Verified.

>Invalid info found, will be replaced.

>Serious buyers will be welcome & I will give discounts on bulk orders.

>Fresh spammed data of USA Credit Bureau

>Good credit Scores, 700 minimum scores

>Bulk order will be preferable

>Minimum order 20 leads/fullz

>Hope for the long term business

>You can asked for samples, specific states & zips (if needed)

>Payment mode BTC, ETH, LTC, Paypal & PERFECT MONEY

Email > leads.sellers1212@gmail.com

Telegram > @leadsupplier

ICQ > 752822040

''OTHER GADGETS PROVIDING''

>SSN Fullz

>CC fullz

>Dead Fullz

>Carding Tutorials

>Hacking Tutorials

>SMTP Linux Root

>DUMPS with pins track 1 and 2

>Sock Tools

>Server I.P's

>USA emails with passwords (bulk order preferable)

**Contact 24/7**

Email > leads.sellers1212@gmail.com

Telegram > @leadsupplier

ICQ > 752822040