China has started 2016 in fire-fighting mode.

After three months of relative calm in the nation’s $6.5 trillion stock market, a 7 percent rout to open the new year prompted government funds to prop up share prices on Tuesday, according to people familiar with the matter. The central bank injected the most cash since September into the financial system to keep a lid on borrowing costs, while the monetary authority was also said to intervene in the currency market to prevent excessive volatility.

With Chinese shares and the yuan posting their worst starts to a year in at least two decades, the ruling Communist Party is being forced to scale back efforts to let markets have more sway in the world’s second-largest economy. Private data this week showed the nation’s manufacturing sector ended last year with a 10th straight month of contraction, amplifying concern that the weakest economic growth in 25 years will fuel capital outflows.

“There’s no doubt China wants to liberalize markets, but it’s happening at such a time that it’s very difficult to do in an orderly manner,” said Ken Peng, a strategist at Citigroup Inc. in Hong Kong.

While Chinese policy makers have said freer markets are integral to their plans to make the country’s economic expansion more sustainable, authorities are also concerned that sinking asset prices will weigh on business and consumer confidence. Capital outflows from China swelled to an estimated $367 billion in the three months ended November, according to data compiled by Bloomberg.

The stock market’s selloff on Monday was triggered by this week’s disappointing manufacturing data, along with investor worries that an expiring ban on stake sales by major shareholders would unleash a flood of sell orders at the end of this week. Those concerns eased on Tuesday as people familiar with the matter said regulators plan to keep the restrictions in place beyond Jan. 8.

To support share prices, government funds targeted companies in the finance and steel sectors, among others, said the people, who asked not to be identified because the buying wasn’t publicly disclosed. The plunge on Monday triggered the nation’s circuit breakers on their first day, dealing a blow to regulatory efforts to restore calm to a market where individuals drive more than 80 percent of trading. The CSI 300 Index of large-cap shares rose 0.3 percent at the close on Tuesday.

Yuan Intervention

"Unfortunately, I think the reality is that we still need some of that state support or intervention, partly because of the investor base you have in China,” Tai Hui, the Hong Kong-based chief Asia market strategist at JPMorgan Asset Management, said at a briefing. “You simply can’t withdraw everything at the same time."

Policy makers went to extreme lengths to prop up share prices in the midst of a $5 trillion rout last summer, including ordering equity purchases by state funds, suspending initial public offerings and allowing trading halts that froze hundreds of mainland-listed shares.

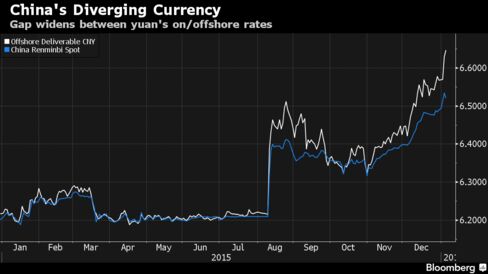

In China’s foreign exchange market, the central bank intervened on Tuesday through state-owned commercial banks, according to a person with direct knowledge of matter. The onshore yuan strengthened 0.18 percent to 6.5219 at 5:43 p.m. local time, following a 0.62 percent drop on Monday. That was the biggest decline to start the year since 1994, when the official exchange rate tumbled as China ended a dual-currency system.

The central bank’s intervention followed a reverse-repo operation on Tuesday that added 130 billion yuan ($19.9 billion) to the financial system, far exceeding the 10 billion yuan drained by maturing contracts. The overnight repurchase rate, a gauge of interbank funding availability, fell one basis point to 2.01 percent as of 4:30 p.m. in Shanghai, according to a weighted average from the National Interbank Funding Center. It climbed to 2.12 percent on Dec. 31, the highest since April.

Market Meddling

Of course, China isn’t the only country with a history of intervention in markets. Hong Kong authorities bought $15 billion of shares to help defend the city’s currency peg during the Asian financial crisis in 1998, while the U.S. Securities and Exchange Commission temporarily banned short selling on some stocks during the global financial crisis.

"Any government that sees some very unstable market movements these days cares," said Khiem Do, the Hong Kong-based head of multi-asset strategy at Baring Asset Management Ltd., which oversees about $45 billion. ”The U.S. cares, Europe cares, Japan cares, and I’m not surprised China also cares.”

For some investors, China’s meddling in markets has gone too far. When the six-month ban on selling by major shareholders was announced in July, it drew criticism from major money managers including Templeton Emerging Markets Group and UBS Wealth Management. At the end of last month, all seven strategists and fund managers surveyed by Bloomberg said they expected regulators to let the restriction lapse this week.

Market intervention is pushing domestic valuations further away from those in freely-traded markets just across the border in Hong Kong. The offshore yuan’s discount to the mainland rate is quadruple the average gap recorded in November, while yuan borrowing costs in the two cities are drifting apart. Dual-listed shares are now 38 percent more expensive in Shanghai after trading at parity as recently as November 2014.

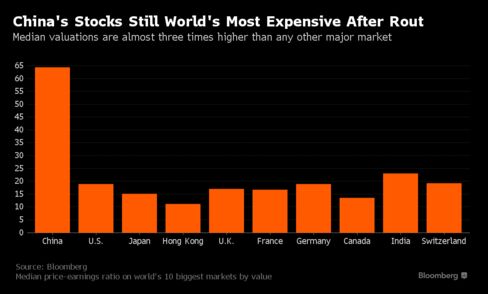

Even after Monday’s drop, the median stock on mainland exchanges trades at about 65 times reported earnings -- more than three times higher than the multiple on U.S. bourses.

“We don’t really like market intervention,” said Stephen Ma, a Hong Kong-based senior portfolio manager at LGM Investments Ltd., whose parent oversees more than $254 billion. “The government should have learned their lesson last summer.”

No comments:

Post a Comment