At Shell, It’s Not Oil...

At Australia’s Curtis Island, you can see Big Oil morphing into Big Gas. Just off the continent’s rugged northeastern coast lies a 667-acre liquefied natural gas (LNG) terminal owned by Royal Dutch Shell, an engineering feat of staggering complexity. Gas from more than 2,500 wells travels hundreds of miles by pipeline to the island, where it’s chilled and pumped into 10-story-high tanks before being loaded onto massive ships. “We’re more a gas company than an oil company,” says Ben van Beurden, Shell’s chief executive officer. “If you have to place bets, which we have to, I’d rather place them there.”

Van Beurden

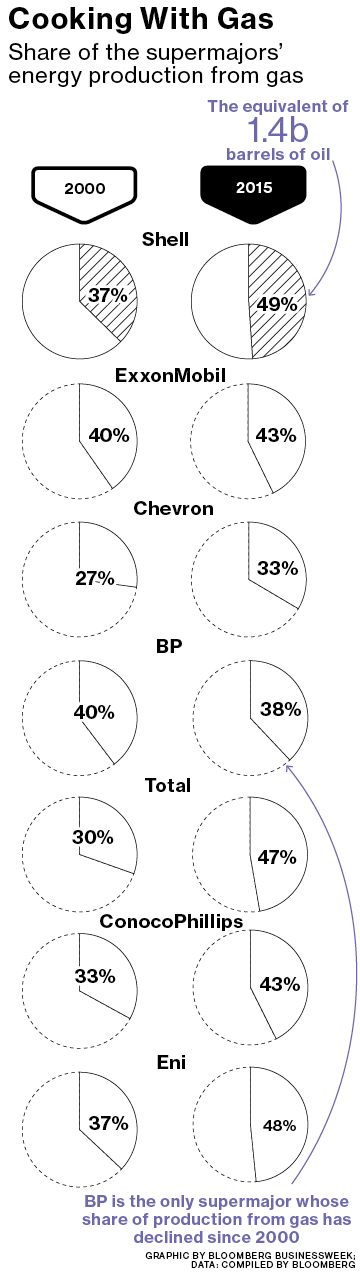

Van Beurden is betting on gas projects such as Curtis Island to address the central challenge facing all oil giants: how to survive in a world moving ever faster toward new ways of producing and consuming energy. A crucial element of Shell’s pivot toward gas was its $54 billion takeover of BG Group. The deal, which closed in February, gave the company Curtis Island, other massive LNG plants, and gas fields from the U.S. to Kazakhstan. It now has a 20 percent share of the global LNG market, scores of giant gas tankers prowling the seas, and double the production capacity of its closest competitor, ExxonMobil.

For Shell, grappling with increasingly ambitious government commitments to slow climate change, gas has much to recommend it. It’s considered a crucial “bridge fuel” in the transition to a low-carbon future, because gas-fired power plants are far cleaner than those that burn coal. They’re also relatively cheap to build and easy to switch on and off, making them a natural complement to solar and wind generation. Shell is also working to create a market for gas-fueled vehicles, especially ships and heavy trucks that, unlike cars, won’t go electric soon. If Shell gets it right, gas is “not just going to be a bridge” but a lucrative part of the energy mix indefinitely, Van Beurden says.

He faces substantial obstacles in his quest, including the high cost of production and the continued abundance of cheap coal. Investors such as Jim Chanos, president of investment firm Kynikos Associates, argue there’s a global glut of LNG, and in June the International Energy Agency downgraded gas growth forecasts, saying “markets will struggle to absorb” new supplies. The price of LNG for delivery to Northeast Asia, home to the biggest importers, is down 30 percent in the past year.

The most important long-term challenge may be the rise of renewables. In Mexico and Morocco, producers of solar and wind power have promised to supply electricity at some of the lowest rates from any source, according to Bloomberg New Energy Finance. Global investment in renewables is outpacing that in fossil fuels 2 to 1, and batteries to store power when the sun doesn’t shine or the wind doesn’t blow are getting cheaper and improving in capacity—which also bolsters the case for electric cars. “The transformation to a world led by renewables is going to be faster” than oil executives think, says Mark Moody-Stuart, a former Shell chairman who now serves on the board of Saudi Aramco.

Shell prides itself on taking a longer and more clear-eyed view of the future than its rivals. In the 1970s it began drafting “Shell Scenarios,” detailed analyses of global politics and economics, and their implications for energy demand. It’s been less hesitant than competitors such as ExxonMobil—the only private oil company that’s larger—to acknowledge the need to cut carbon emissions and invest in greener energy as a hedge. This year it created a unit for renewables, and Van Beurden in June told investors that Shell “strongly supports” global agreements to limit climate change.

As Shell plots a course through the new business environment, Van Beurden is pushing to deliver on the promise of the BG deal. That means discovering ways to drive down the cost of LNG facilities, by, for example, accepting a little less reliability in exchange for simpler designs, says gas business head Maarten Wetselaar. It will also require finding new customers to make up for lower-than-expected gas demand in countries such as China. Shell last year became Jordan’s first LNG supplier, making deliveries to a brand-new import terminal on the Gulf of Aqaba. Yet the company is postponing some projects: On July 11 it delayed building an export terminal on Canada’s Pacific coast, citing “global industry challenges.”

Those worries haven’t slowed the pace at Curtis Island, where a supertanker loaded with fuel departs every three days. Next to its two production units, the mangroves have been cleared for a third that could increase capacity by 40 percent. For such a sprawling operation, the facility is relatively quiet, with only 300 employees. Most of the time, the only noise is a muffled, high-pitched whir—the sound of miles of metal turning gas into cash, at least for now.

The bottom line: Shell’s purchase of BG Group increased its lead in LNG production, but the rapid rise of renewables makes that a risky bet.

Selling USA FRESH SPAMMED SSN Leads/Fullz, along with Driving License/ID Number with EXCELLENT connectivity.

ReplyDelete**PRICE**

>>1$ FOR EACH FULLZ WITHOUT DL NUMBER

>>2$ FOR EACH LEAD/FULLZ/PROFILE

>>5$ FOR EACH PREMIUM LEAD/FULLZ/PROFILE

**DETAILS IN EACH LEAD/FULLZ**

->FULL NAME

->SSN

->DATE OF BIRTH

->DRIVING LICENSE NUMBER WITH EXPIRY DATE

->ADDRESS WITH ZIP

->PHONE NUMBER, EMAIL, I.P ADDRESS

->EMPLOYEE DETAILS

->REALTIONSHIP DETAILS

->MORTGAGE INFO

->BANK ACCOUNT DETAILS

>All Leads are Tested & Verified.

>Invalid info found, will be replaced.

>Serious buyers will be welcome & I will give discounts on bulk orders.

>Fresh spammed data of USA Credit Bureau

>Good credit Scores, 700 minimum scores

>Bulk order will be preferable

>Minimum order 20 leads/fullz

>Hope for the long term business

>You can asked for samples, specific states & zips (if needed)

>Payment mode BTC, ETH, LTC, Paypal & PERFECT MONEY

Email > leads.sellers1212@gmail.com

Telegram > @leadsupplier

ICQ > 752822040

''OTHER GADGETS PROVIDING''

>SSN Fullz

>CC fullz

>Dead Fullz

>Carding Tutorials

>Hacking Tutorials

>SMTP Linux Root

>DUMPS with pins track 1 and 2

>Sock Tools

>Server I.P's

>USA emails with passwords (bulk order preferable)

**Contact 24/7**

Email > leads.sellers1212@gmail.com

Telegram > @leadsupplier

ICQ > 752822040